Omdia evaluation of Sensor Tower knowledge reveals that the Meta Quest cell companion app downloads fell on Christmas Day 2024 by 27% in comparison with 2023, regardless of the launch of the Meta Quest 3S in October. Priced from $300, the Quest 3S is a follow-up to the extremely profitable Quest 2. There was a palpable hope throughout the trade that it might reinvigorate VR {hardware} gross sales because of its enticing value (ranging from $300), bundling the brand new Batman: Arkham Shadow recreation, and its enhanced passthrough blended actuality options.

Determine 1: Meta Quest cell app downloads over the previous six years

Complete 2024 app downloads grew barely to 7.8 million, however that is nonetheless effectively under 2022’s report of 10.3 million (see Determine 1). December’s complete downloads had been down by 21% year-on-year. Even with an attractively priced bundle and good consciousness for the model, the Quest 3S struggled to draw new customers, signaling broader challenges within the VR market (see: Actuality examine for VR: Omdia forecasts decline as Apple’s entry fails to provoke market).

Whereas not an actual illustration of Quest headset gross sales, Meta Quest app obtain figures function barometer, given the cell app have to be downloaded as a part of the preliminary setup of the headset. Sensor Tower doesn’t depend re-downloads, app updates, or subsequent downloads on new or extra gadgets for an current iOS/Google Play account.

Components like second-hand gross sales, upgrades, headset sharing, and non-owners downloading the app to discover the app retailer muddy the info. Nonetheless, the flat app obtain figures strongly point out that Meta shouldn’t be considerably increasing the Quest’s viewers past its current consumer base. This aligns with different indicative knowledge, corresponding to gross sales figures on Amazon product pages and VR headset parts channel knowledge, which equally level to a plateauing market. Meta’s rising deal with good glasses indicators a shift in technique, as the corporate explores different kind components which will higher enchantment to the mass market than VR.

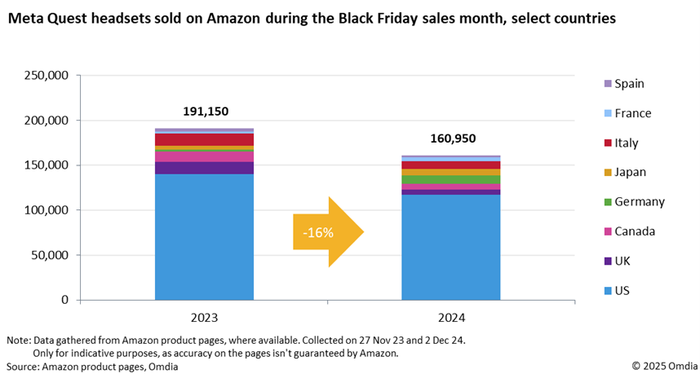

Indicative Amazon knowledge suggests Meta Quest gross sales underperformed throughout Black Friday month

In accordance with knowledge from Amazon product pages, over 160,000 Quest headsets had been bought in November 2024 throughout eight nations – down by 16% in comparison with 2023 (see Determine 2). The Quest 3S accounted for 66% of gross sales, with the Quest 3 making up the rest. November sometimes marks the height VR gross sales attributable to Black Friday and Cyber Monday, throughout which Meta supplied substantial reductions on each Quest 3 and Quest 3S fashions in all markets. The US website represented 73% of complete gross sales, offering indication of the worldwide image.

Quest 3S struggled to draw new VR customers or function a compelling improve for Quest 2 homeowners, as its enhancements had been seen as incremental. Internally, the Quest 3S is similar to the Quest 2 and retains its bulkiness, largely as a result of ongoing use of Fresnel lenses. A recurring criticism from reviewers and customers has been its inferior consolation in comparison with the Quest 3—which seemingly stems from Meta’s cost-cutting measures. Additional hindering Quest 3S’ enchantment is the restricted AR content material totally leveraging its improved {hardware}, in addition to the compatibility of most Quest Retailer content material with the Quest 2. These components, mixed with VR’s continued incapacity to enchantment to a broader viewers past current fanatics, dampened demand throughout the vacation season.

Determine 2: Quest headset gross sales on Amazon declined 16% YoY throughout the Black Friday gross sales month

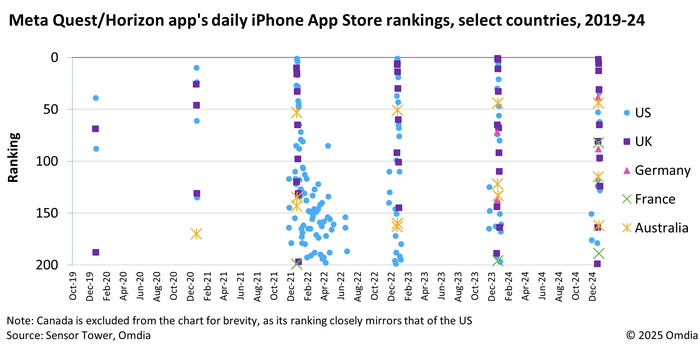

The Meta Quest smartphone app rating knowledge underlines the seasonal nature of headset gross sales and their US-centricity

The Meta Quest iPhone app’s recurring look within the prime 200 free app rankings throughout the vacation season aligns with the seasonal development of headset gross sales, notably round Christmas when these gadgets are fashionable items. This sample additionally underscores the dominance of the US, Canada, and UK as key markets, the place the app reliably breaks into the highest 10 and infrequently briefly reaches the #1 spot on the Christmas Day. In stark distinction, the opposite three nations—Germany, France, and Australia—hover a lot additional down the rankings, by no means coming near the highest 10 and barely breaking into the highest 50, highlighting a major hole in market engagement (see Determine 3).

Determine 3: iPhone App Retailer rating knowledge underlines Meta Quest headsets’ seasonality and prominence within the US

Though the surge in recognition and peak concurrent customers participating in VR video games throughout the vacation interval indicators some constructive curiosity, the bigger points surrounding the VR class persist. In accordance with Omdia’s Client VR Headset and Content material Income Forecast, headset gross sales fell by 10% in 2024 to six.9 million items, whereas these in energetic use fell by 8% to 21.9 million. Engagement all year long is inconsistent, posing a major hurdle to Meta’s ambition of cultivating a self-sustaining VR ecosystem. Restricted compelling new content material, builders questioning the ROI of VR initiatives, and an absence of broader shopper curiosity are the elemental challenges that might be troublesome to beat, so long as VR headsets stay of their present kind.